Sam, Kerry, and Remy Singh. Photo: votesamsingh.com

“But it’s not just seniors who would benefit from the elimination of the retirement tax. More money in their pockets means more money in our communities. Everybody wins when seniors eat at our restaurants and drink locally-brewed beers and shop at our small businesses. It’s also a tax break that every Michigander could become eligible for once they start tapping into a retirement account. “

OPINION—Much of Michigan’s magnificence was built by the people who are now either in their Golden Years or nearing them. Our parents and grandparents – whether they came here as immigrants or can trace their roots back for generations – worked in factories and farms, built our roads and our restaurants. They were doctors and nurses, musicians and mechanics, teachers and engineers. They were stay-at-home parents and administrative assistants and bus drivers. They made cars and ran libraries, cleaned houses and landscaped our parks. Perhaps they had a government job in Lansing or a campus job at Michigan State.

Many are still employed, while others have retired from the workforce after decades of service. What they all have in common, however, is that their contributions made Michigan what it is today. And for that, they have earned the right to enjoy their best years – years of leisure and exploration, of spending time with family and discovering new hobbies and meeting new friends – in comfort and dignity. Michigan owes that debt to our seniors, which is why the Legislature should repeal the retirement tax.

Prior to 2011, Michigan did not tax pensions. But that changed under Gov. Rick Snyder, who put seniors on the chopping block when he changed the tax code. Protections were grandfathered in for folks born before 1946, but no one who is now under the age of 67 can deduct a dime of their retirement income. Once that milestone birthday is reached, retirees can only deduct the first $20,000 of income (or $40,000 for married couples filing jointly).

That’s not enough, and it’s past time to right that wrong. Seniors are on fixed incomes and have sacrificed their fair share by paying taxes throughout their careers. Why not finally let them keep what they’ve earned? The state is on solid financial ground to protect every penny of people’s pensions from taxation, regardless of the retiree’s age. We can also reinstate deductions for private retirement income, including private pensions, 401(k)s and IRAs.

We must act with urgency. Aside from the obvious and immediate burden of inflation, there will simply be more seniors soon. Michigan is one of the fastest-aging states in the nation; in less than a decade, nearly a quarter of our population will be over the age of 60. Already, in Clinton and Shiawassee Counties, nearly one in five people have reached 65.

But it’s not just seniors who would benefit from the elimination of the retirement tax. More money in their pockets means more money in our communities. Everybody wins when seniors eat at our restaurants and drink locally-brewed beers and shop at our small businesses. It’s also a tax break that every Michigander could become eligible for once they start tapping into a retirement account.

Finally, it’s worth noting that Michigan is losing population. When people leave, our sales tax revenue and local economies suffer. If we want to attract more people to come here, then we need to make ourselves attractive to them. By eliminating the retirement tax, we’re putting our money where our mouth is in selling Michigan as an age-friendly state.

Sam Singh is the former Minority Leader in the Michigan House of Representatives. He is the Democratic nominee for State Senate District 28, which encompasses parts of Ingham, Clinton, and Shiawassee Counties.

Politics

Whitmer expands clean water plan while enviros call for more clean energy investments

BY KYLE DAVIDSON, MICHIGAN ADVANCE MICHIGAN—As construction workers at the Delta Township Wastewater recovery facility continued efforts to expand...

Michigan Dems push for action on prescription drug board bills

BY KYLE DAVIDSON, MICHIGAN ADVANCE MICHIGAN—Four Democratic House members are renewing the call for action on prescription drug affordability,...

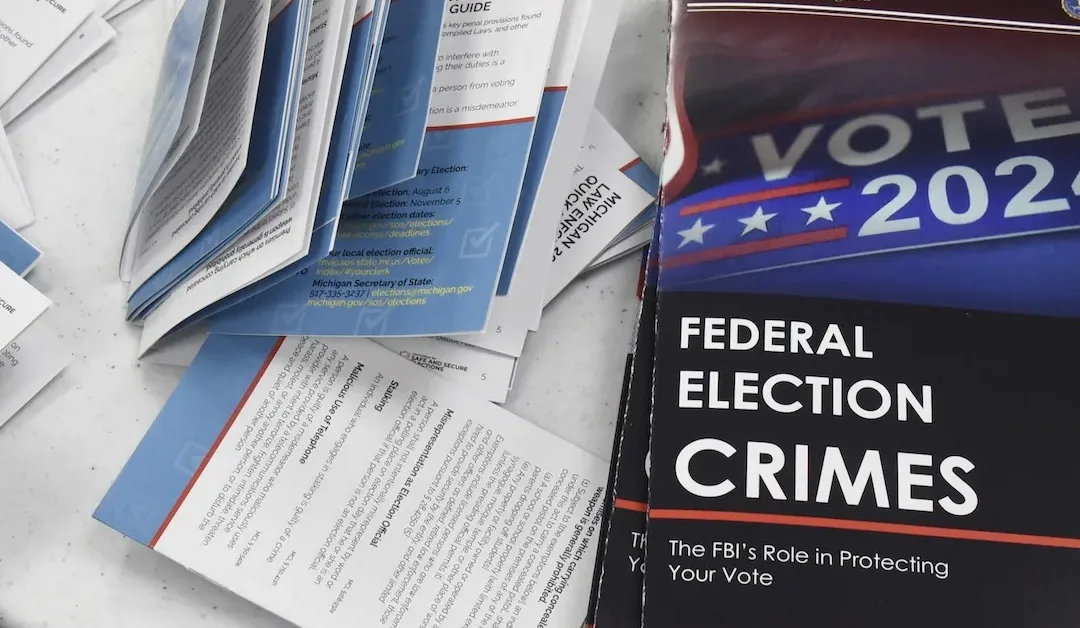

Local election workers fear threats to their safety as November nears. One group is trying to help.

TRAVERSE CITY—The group gathered inside the conference room, mostly women, fell silent as the audio recording began to play. The male voice, clearly...

Local News

These students are protecting the ‘coral reefs’ of Michigan—and you can too

Vernal pools are a critical part of Michigan’s natural ecosystem—but they’re not protected by state regulations. Here’s how Michiganders are...

The food at Comerica Park puts peanuts & Cracker Jacks to shame

Gone are the days when peanuts and Cracker Jacks were the most exciting food items at baseball games. Baseball stadiums around the country now boast...