“That’s money for prescriptions, rent, car payments, or gifts for grandkids,” Whitmer said during her State of the State speech on Wednesday.

Need to Know

- Under current law, all retirement income is taxed for Michiganders born after 1946.

- Gov. Gretchen Whitmer wants to eliminate the tax, which would save an estimated half-a-million households $1,000 per year, according to her office.

- Retired steelworker Steve Turri say this policy would provide he and his wife more financial security

MICHIGAN–Retirees in Michigan could soon save $1,000 per year under a plan proposed by Gov. Gretchen Whitmer.

Gov. Whitmer has announced a plan to repeal the so-called retirement tax. Under current state law, all retirement income–including pensions, 401k accounts, and IRAs–is taxed for Michiganders born after 1946. Whitmer’s effort would repeal that tax and save an estimated half-a-million households $1,000 per year, according to her office.

“That’s money for prescriptions, rent, car payments, or gifts for grandkids,” Whitmer said during her State of the State speech. “Repealing the retirement tax will help real people.”

Her proposal has already gained support from the Michigan AFL-CIO, the Michigan Education Association, the Detroit Urban League, and AARP Michigan.

“Michiganders who have worked hard, played by the rules and paid their dues deserve to retire with dignity, but too many have been forced to go back to work to pay the bills,” AARP Michigan Director Paula D. Cunningham said in a statement. “We urge state legislators to do the right thing by repealing this law and help build Michigan’s reputation as the first ‘age-friendly’ state in the Midwest.”

RELATED: ‘We Have to Do More’: How Michigan Is Investing in its Senior Residents

Whitmer noted that she opposed the retirement tax when it was passed in 2011 under former Republican Gov. Rick Snyder. Whitmer served in the state legislature at the time. She also tried to repeal the tax during budget negotiations in 2019, but was unable to get the Republican-led legislature on board.

If Republicans agree to Whitmer’s plan this time around–and there are indications they might–seniors would be free from the retirement tax by the end of 2024. That would provide a huge help to Steve Turri, a Negaunee resident and retired steelworker.

“I worked for 31 years as a Steelworker. In 2004 I retired with a pension to provide for my wife and me. My pension is a lynchpin for our financial security,” Turri said in a statement. “The law that taxed my pension years later has been unfair to us. I fully support the Governor’s proposal to repeal the pension tax.”

Politics

Whitmer expands clean water plan while enviros call for more clean energy investments

BY KYLE DAVIDSON, MICHIGAN ADVANCE MICHIGAN—As construction workers at the Delta Township Wastewater recovery facility continued efforts to expand...

Michigan Dems push for action on prescription drug board bills

BY KYLE DAVIDSON, MICHIGAN ADVANCE MICHIGAN—Four Democratic House members are renewing the call for action on prescription drug affordability,...

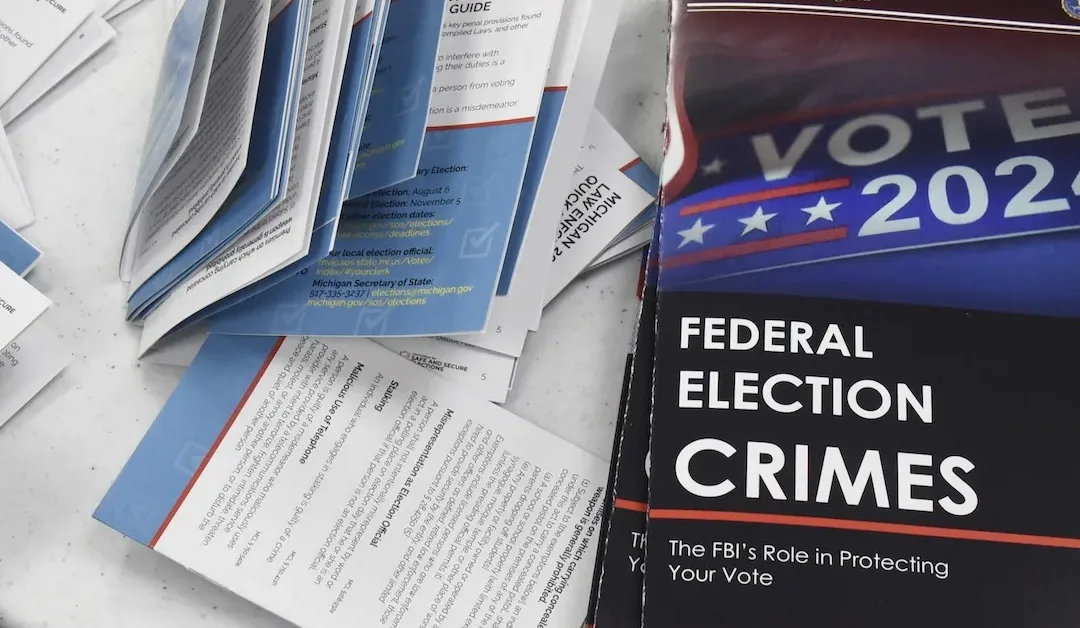

Local election workers fear threats to their safety as November nears. One group is trying to help.

TRAVERSE CITY—The group gathered inside the conference room, mostly women, fell silent as the audio recording began to play. The male voice, clearly...

Local News

These students are protecting the ‘coral reefs’ of Michigan—and you can too

Vernal pools are a critical part of Michigan’s natural ecosystem—but they’re not protected by state regulations. Here’s how Michiganders are...

The food at Comerica Park puts peanuts & Cracker Jacks to shame

Gone are the days when peanuts and Cracker Jacks were the most exciting food items at baseball games. Baseball stadiums around the country now boast...