From higher utility bills to job cuts across multiple industries, Michiganders can expect their wallets to feel a little thinner this year—and in years to come—thanks to the Trump administration’s One Big Beautiful Bill Act… and these Republicans who supported it.

As the ink dries on Trump’s “One Big Beautiful Bill Act,” which was backed by seven Michigan Republicans—including US Reps. Tom Barrett, Jack Bergman, Bill Huizenga, John James, John Moolenaar, Lisa McClain, and Tim Walberg—analyses have revealed just how much Michiganders, and their wallets, will be impacted over the next several months and years.

From rising household utility bills to eliminating thousands of job opportunities across multiple industries to cutting critical health care resources, here’s how Trump’s tax bill will affect ‘Ganders—all while providing tax cuts to the rich.

Shifting $150 million for parks and conservation onto Michigan taxpayers

Trump’s tax bill repealed funding for National Park Service maintenance and staffing, putting strain on already-overburdened public lands during the peak summer visitation.

A report from Climate Power estimates that Trump’s plans would shift more than $150 million in park maintenance and additional staffing costs onto Michigan taxpayers, while simultaneously raising visitor fees, slashing tourism revenue, and putting active military and veterans’ benefits at risk.

Related: Report: Trump’s plan to offload national parks would cost Michigan millions

Rollbacks on clean energy incentives will lead to higher utility bills

As projects are delayed or cancelled altogether, the bill’s repeal of clean energy tax credits and its slowdown of renewable energy could cost Michigan an estimated 19,000 manufacturing and clean energy jobs by 2035. This is especially concerning as manufacturing accounts for about 16% of Michigan’s economic output.

As these jobs and industries are eliminated, analysts forecast Michiganders will feel the effects as early as next year—when utility bills are expected to increase by as much as $110 per household per year and $400 within a decade.

Watch: Trump slams brakes on Michigan’s clean energy future

More expensive grocery bills

Trump’s tax bill will slash annual federal spending by $285 billion over the next decade, forcing individual states to pick up the bill to keep the Supplemental Nutrition Assistance Program (SNAP) going.

In Michigan, those extra costs could reach as high as $900 million a year, according to state estimates. But even if the state fills the gap, the new work requirements in the tax bill will soon force more than 270,000 Michiganders statewide to lose their SNAP benefits.

Cuts to SNAP will also impact local grocery stores, farmers markets, and other stores in Michigan. In 2024, over $3 billion in SNAP benefits were spent at Michigan retailers, which directly contributed to local economies and supported food access in both urban and rural communities.

Related: Trump’s budget law will hurt thousands in Michigan—and these Republicans voted for it

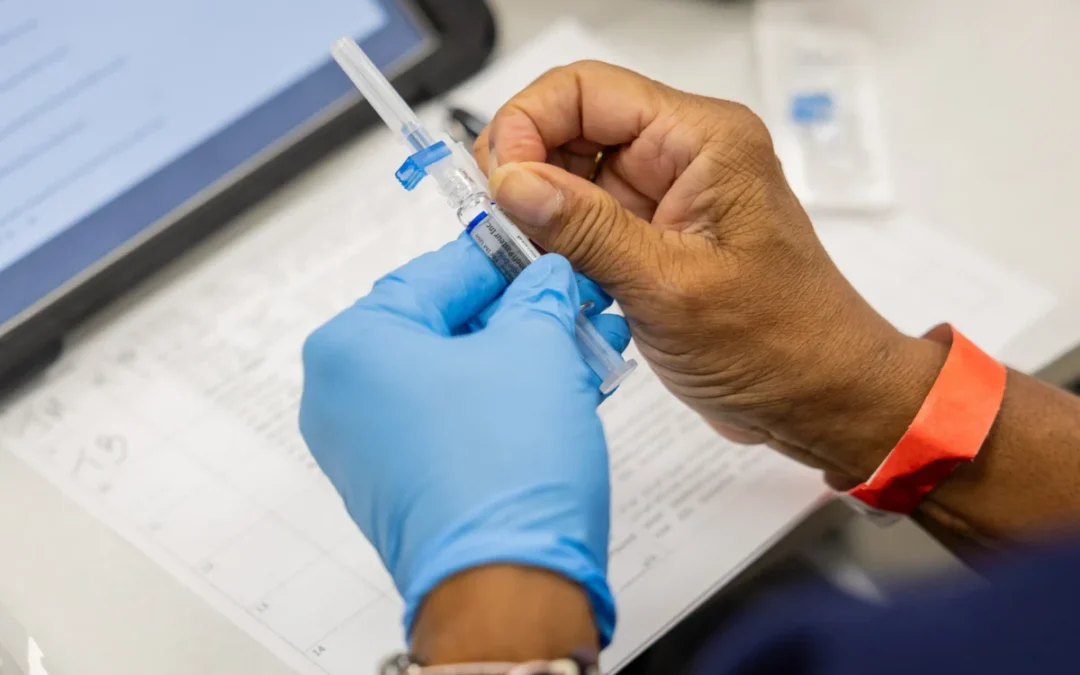

Health care cuts

Medicaid currently covers about 2.6 million Michiganders—roughly one in four residents—including three in five nursing home patients, nearly half of all births, and 300,000 people with disabilities, according to data provided by Gov. Gretchen Whitmer’s office.

Additional reports indicate that Trump’s tax bill will eliminate nearly $1 trillion from the Medicaid program over the next decade. As a result, state officials say 200,000 Michiganders could lose their coverage altogether—largely due to new paperwork requirements and eligibility checks included in the newly signed federal legislation that make it difficult for people to stay on Medicaid when their hours fluctuate, when their school schedules change from term to term, or because they find the online reporting system hard to navigate.

The cuts are also set to gut a key source of funding for nursing homes, hospitals, and health care providers, especially in rural areas, where Medicaid covers a majority of these services. Analysts project that at least 187 health center sites around the state will close and 41,000 health care jobs will be cut by 2029 due to the changes made by Trump’s tax bill.

Related: 7 Michigan Republicans vote to help Trump gut health care for 200,000 Michiganders

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Michiganders and our future.

Since day one, our goal here at The 'Gander has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Michigan families—they will be inspired to become civically engaged.

A new car vs. health insurance? Average family job-based coverage hits $27K

By Phil Galewitz, KFF Health News With the federal shutdown entering its fourth week, spurred by a stalemate over the cost of health insurance for...

Fighting a health insurance denial? Here are 7 tips to help

By: Lauren Sausser When Sally Nix found out that her health insurance company wouldn’t pay for an expensive, doctor-recommended treatment to ease...

It’s almost flu season. Should you still get a shot, and will insurance cover it?

Madison Czopek, PolitiFact August 18, 2025 For parents of school-aged children, the fall to-do list can seem ever-growing. Buy school supplies. Fill...

Opinion: Health care is at risk as Grad PLUS loans face the chopping block

The ‘One Big, Beautiful Bill Act’ strips critical funding from medical students and threatens care in rural and underserved communities. We never...

Macomb County households will start losing money this year under Trump’s new spending law. Here’s how much—and who let it happen

Families in Michigan’s 10th Congressional District will shoulder over $500 million in lost funding, while billionaires cash in. In the neighborhoods...