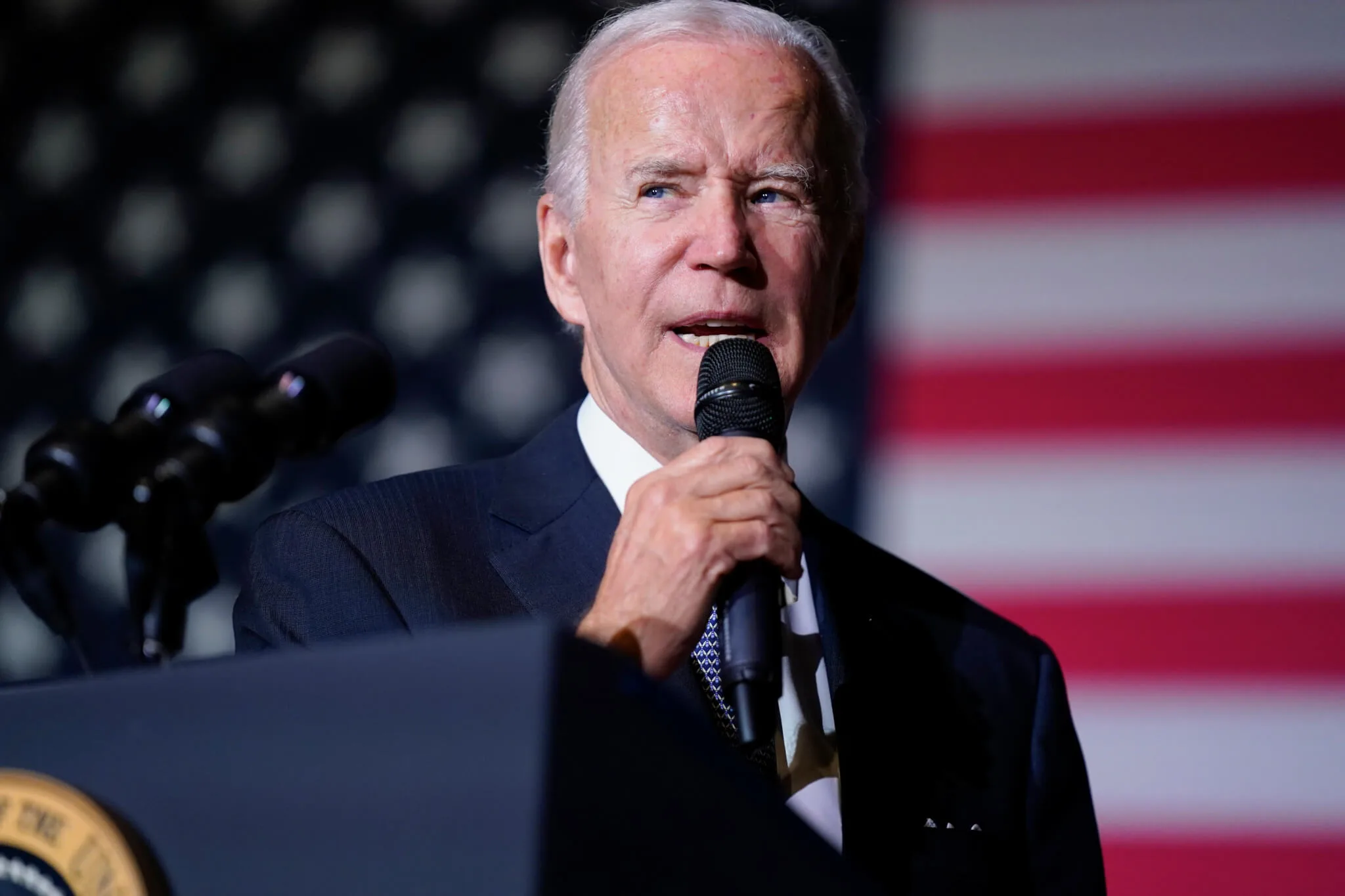

The Biden administration has begun the process of creating a new plan for widespread loan cancellation and implementing the SAVE Plan, which will cut monthly payments to $0 for millions of borrowers. There will also be a 12-month “on-ramp” period to ease borrowers back into making payments. (AP Photo/Evan Vucci, File)

On June 30, the Supreme Court struck down President Biden’s student loan cancellation plan, a major blow to tens of millions of working- and middle-class Americans who stood to benefit from the program.

Under Biden’s plan, an estimated 20 million people were expected to be eligible to have their remaining debt fully canceled, with benefits overwhelmingly flowing to Americans earning under $75,000 per year.

However, hours after SCOTUS delivered its ruling, President Biden said that his administration would begin exploring other options for relief. “Today’s decision has closed one path. Now we’re going to pursue another,” he said.

Since then, the Biden administration has launched additional efforts to try to get Americans student debt relief, including announcing a plan that will allow more than 800,000 borrowers to have their debt erased if they’ve been paying it down for at least 20 years.

Here’s a breakdown of the administration’s other efforts:

Exploring Other Options

First, the president has directed the Department of Education to come up with a new plan for widespread loan cancellation through the Higher Education Act.

“We started the process to provide relief to as many people as we can, as fast as we can, through the rulemaking process,” Secretary of Education Miguel Cardona said on July 16. “Under the law, this path will take time, but we are determined to keep fighting for borrowers and we will keep you updated in the months ahead.”

On July 18, a virtual public hearing was held where members of the public were able to weigh in on the latest relief plan, and learn more about how it will work. Now, the Education Department is in the process of finalizing the issues to be addressed in the fall, when negotiated “rulemaking” sessions will begin, according to the White House.

These sessions will effectively help determine the terms of any newly enacted law that would bring debt relief.

“We look forward to participating in the negotiated rulemaking process and appreciate the Biden administration’s willingness to deliver debt relief in the face of last month’s unjust ruling by the Supreme Court,” Mike Pierce, executive director of the Student Borrower Protection Center, said during the hearing on Wednesday.

Implementing the SAVE Plan

The Biden administration is also in the process of implementing what it calls “the most affordable repayment plan ever created:” The Saving on a Valuable Education (SAVE) Plan. Borrowers that enroll will start saving money under this new plan later this summer.

The SAVE Plan will cut monthly payments to $0 for millions of borrowers making $32,800 or less individually per year. The cutoff will be $67,500 per year for a borrower in a family of four. According to the Biden administration, all other borrowers will save at least $1,000 per year under this plan.

The SAVE Plan will also “stop runaway interest” that “leaves borrowers owing more than their initial loan,” Secretary Cardona said in a statement. For example, under this plan, borrowers with unpaid monthly interest will not be charged as long as they make their monthly payments.

Those who are interested in enrolling in the SAVE Plan should apply for the Revised Pay as You Earn (REPAYE) plan today; the Dept. of Education will automatically enroll these borrowers and update their monthly payments when the SAVE Plan is fully implemented.

To learn more about the SAVE Plan, click here.

Restarting Payments

Finally, borrowers should also keep in mind that the student loan payment pause is ending.

For over three years, the student loan collection system has been frozen. Former President Donald Trump initiated the hiatus as a two-month pause in March 2020, when the COVID-19 pandemic first began ravaging the U.S. economy.

Now, interest will begin accruing again on Sept. 1, and payments will be due again in October.

To help borrowers successfully return to repayment, the Education Department is instituting a 12-month “on-ramp” to repayment, running from Oct. 1, 2023 to Sept. 30, 2024.

Borrowers who miss a payment during this period will not be considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies, according to the White House. It’s also important to note that interest will not capitalize at the end of the on-ramp period, and borrowers do not have to take any action to qualify for this on-ramp period.

However, borrowers who can make their payments should do so, the White House states.

“We will not stop fighting to make sure that student debt is not a barrier for Americans to access college or economic opportunity,” Secretary Cardona said in his statement. “We will continue to put the needs of students and borrowers first, help borrowers access the support and resources they need, and make the promise of college a reality for more American families.”

To learn more about all of these actions, identify a repayment plan that works for you, and consider your options as repayment begins, click here.

Whitmer signs new order to help more Michigan men afford college and job training

A new executive directive from Gov. Gretchen Whitmer aims to connect thousands of young men across Michigan with tuition-free college and career...

Trump revokes visas, legal residency of international students at Michigan universities

The Trump administration has abruptly rescinded the legal residency status and visas of dozens of international students at some of Michigan’s...

University of Michigan braces for funding cuts as feds terminate Social Security project

BY KYLE DAVIDSON, MICHIGAN ADVANCE MICHIGAN—The University of Michigan has begun preparing for potential budget cuts following an announcement from...

Michigan schools among top 25 in national university rankings

Among other high-ranking Michigan schools, the University of Michigan secured the 21st spot in US News' 2025 Best National Universities ranking. As...

Few mothers have served in the Michigan Legislature while raising children

BY ANNA LIZ NICHOLS, MICHIGAN ADVANCE MICHIGAN—When Debbie Stabenow was serving in the Michigan House in 1980, she did something that had never been...