Photo courtesy of Shutterstock.

Lt. Governor Garlin Gilchrist II and the Michigan Economic Development Corporation (MEDC) have announced the Michigan Strategic Fund’s approval of up to $22 million in State Small Business Credit Initiative (SSBCI) 2.0 Michigan Small Business Venture Capital Program (SBVCP) funds. These funds are designated to support two venture capital investment funds, Union Heritage’s Future Heritage Fund and Venture Investors Healthcare Fund.

The Future Heritage Fund aims to support Socially Economically Disadvantaged Individuals (SEDI) and very small businesses (VSBs), with Venture Investors Healthcare Fund focusing on early-stage companies in the healthcare sector. This move emphasizes Michigan’s leadership in providing support and fostering innovation for small businesses.

Lt. Governor Garlin Gilchrist II highlighted that the SBVCP funds demonstrate Michigan’s commitment to diverse entrepreneurs, particularly those historically overlooked for funding opportunities. The SBVCP can allocate up to $75 million to increase capital availability for early-stage, technology-based businesses in Michigan. With the support of the U.S. Department of the Treasury, it invests as a limited partner in venture capital funds operating within the state.

Photo courtesy of Garlin Gilchrist II via Instagram.

Both the Future Heritage Fund and Venture Investors Healthcare Fund are eligible for up to $11 million in SBVCP funding, enabling them to invest in companies across the state. If fully utilized, the $22 million in SSBCI investment could result in over $44 million investment in early-stage Michigan businesses.

The Future Heritage Fund aims to generate long-term growth from early-stage venture capital investments in Michigan-based private companies. These companies are primarily led by underrepresented or socially and economically disadvantaged founders, or they provide a service that addresses an issue that disproportionally affects SEDI populations. The fund has a target size of $25 million.

Conversely, the Venture Investors Healthcare Fund will make investments in Michigan-based, early-stage healthcare companies. Its investment portfolio will primarily comprise medical devices and diagnostics, biopharma, therapeutics, and vaccines.

The SSBCI seeks to stimulate private capital in the form of loans to and investments in small businesses. This is especially vital for historically underserved communities and entrepreneurs who may have lacked the necessary support to pursue their business ambitions. Since receiving its first round of SSBCI 2.0 funding ($72 million of the total $236 million allocation from the U.S. Treasury) in May 2022, Michigan has deployed $45 million in SSBCI debt-based capital.

In order to increase small businesses’ awareness of and preparedness for applying for capital, nine SSBCI Technical Assistance providers were chosen in October 2023 to offer legal, accounting, and financial advisory services to entrepreneurs across the state.

Read More About This

Read More Michigan News

This article first appeared on Good Info News Wire and is republished here under a Creative Commons license.

This story was generated in part by AI and edited by The ‘Gander staff.

A historian explores Michigan’s secret bootlegging empire

While we all know that crime doesn't pay, the bootleggers and gangsters of a century ago have always held a certain glamour in popular imagination....

That one time in Michigan: When we established one of the most isolated national parks

A quick history of Isle Royale National Park. It's been nearly 100 years since Congress authorized one of the country's most beautiful and remote...

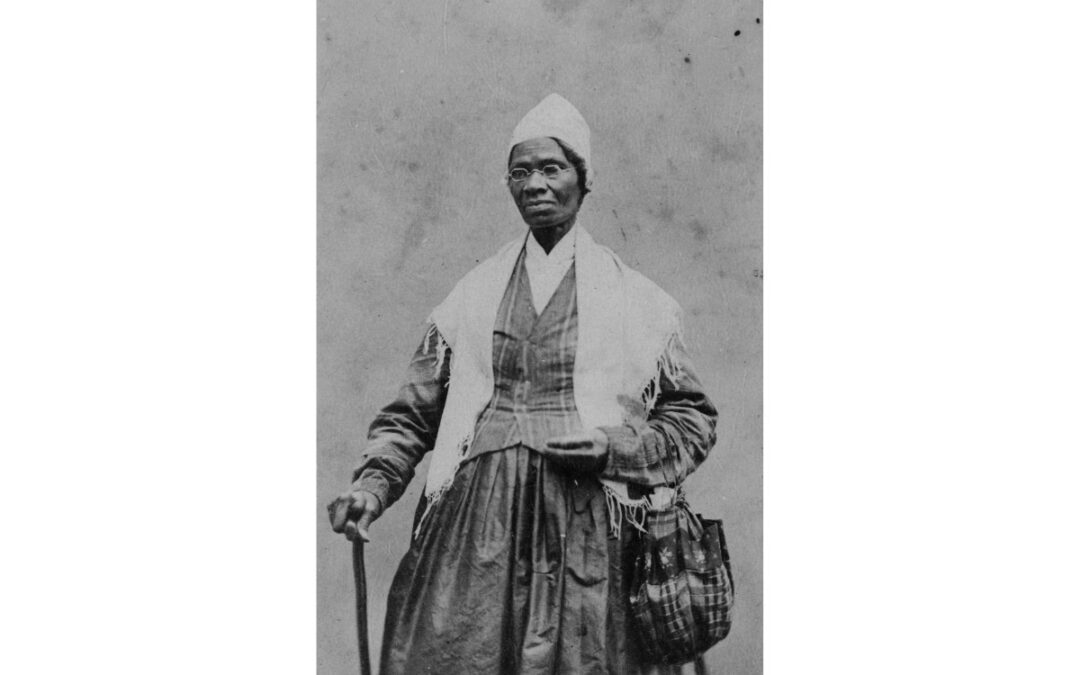

That one time in Michigan: When an abolitionist called Battle Creek home

Did you know that one of the most famous abolitionists in US history called Michigan home? Sojourner Truth, the legendary activist, lived in...

Black History Month explained: Its origins, celebrations and myths

By HAYA PANJWANI Associated Press WASHINGTON (AP) — Beginning Feb. 1, schools, museums and communities across the nation will mark the start of...

Unpacking Detroit’s strong ties to the Mafia

Many crime families and mafia members have called Detroit home over the years. Learn about the Motor City’s mafia connections and ties to organized...