(Common Citizen via Facebook)

Federal legislation could help thousands of Michigan cannabis workers who have struggled to access mortgages and other loans.

MICHIGAN—This month marks five full years of recreational weed being legal in Michigan after voters decided (in huge numbers) to legalize marijuana for adult use back in November 2018.

Since then, Michigan’s cannabis industry has grown to become among the largest in the country. And over the last five years, more than $6.4 billion worth of recreational weed has been grown by more than 1,000 cultivators and sold at more than 700 dispensaries statewide.

All told, the state’s cannabis industry now generates more tax revenue for Michigan than the sale of beer, liquor, and wine combined, and employs nearly 35,000 taxpaying Michiganders.

But because the federal government still considers marijuana to be as addictive and illegal as other Schedule I substances like heroin and ecstasy, thousands of Michiganders who work in the cannabis business are still having trouble accessing loans and other basic banking services.

‘Affecting the whole workforce’

Common Citizen is a cannabis cultivation, processing, retail, and distribution company that launched in Detroit in 2018 and currently employs roughly 700 Michiganders.

(Common Citizen via Facebook)

Amanda McCrary, who heads up the company’s human resources department, said most federally-insured banks and credit unions won’t work with Common Citizen (or any other cannabis company) because weed is still illegal at the federal level. This reluctance stems from the banks’ fears that doing so would violate laws that prevent fraud and money laundering.

And for Common Citizen employees, that has also resulted in denied applications from traditional lenders for home mortgages, student and automotive loans, and credit cards—all because they draw their income from a company that grows and sells weed, McCrary said.

“Our people just don’t have access to programs and loans like other workers in the United States,” McCrary told The ‘Gander. “Sometimes, we’ll even have a hard time getting people to work here because they’re afraid they’re not going to be able to get those home mortgages, car loans, or even their school loans. It’s really an issue that’s been affecting the whole workforce.”

‘A legitimate industry’

Vixen Yerock, who works on the technical side of Common Citizen’s cultivation and processing operation, moved to Michigan from Oklahoma last year to take a job in the weed business.

She said that she was only two weeks away from closing on the sale of her new home when her bank discovered that she was going to be working for one of the largest cannabis companies in Michigan—and then decided to pull out of servicing the loan altogether.

“That forced us into this quick struggle and it took about three weeks to secure another loan,” Yerock said. “It was a very negative experience for us, but luckily we had a really solid team to help us through it. We ended up going to a local bank because we couldn’t go with a large one.”

(Common Citizen via Facebook)

Yerock said her new loan came with a higher interest rate—but like so many others, she didn’t have many options. As many as 428,000 other people working in states where cannabis has been legalized have reportedly dealt with the same issues, with few solutions, for a decade.

“Whether you agree with it or not, cannabis is a legitimate industry in Michigan,” said Mike Beck, director of community and government affairs at Common Citizen. “These workers are paying taxes like everybody else, yet they don’t have the same level of access to banking as everybody else. It just doesn’t make any sense. These people are your neighbors. They’re your friends.”

‘It’s about fairness’

This year, President Joe Biden’s administration recommended reclassifying cannabis to a lower tier of controlled substances. That recommendation now rests with the Drug Enforcement Administration, which could prompt broader changes to federal law and how the federal government views cannabis—including the way regulators enforce federal banking restrictions.

In the meantime, federal lawmakers have been trying to pass more specific bills that would create clear legal protections for banks that choose to do business with cannabis companies.

The latest iteration of that legislation—the SAFER Banking Act—wouldn’t change marijuana’s status as a Schedule I drug, but would clearly outline in federal law that federally insured banks can provide services to cannabis businesses in all states where marijuana has been legalized.

Under the bill, federal regulators would be required to develop new guidance for banks on “cannabis-related deposits,” and would be prohibited from ordering banks to close an account “unless there is a valid reason.” It also reportedly includes language to protect cannabis workers who attempt to obtain residential mortgages that are funded through federal programs.

Beck said the legislation would help open lines of credit to existing cannabis businesses like Common Citizen, as well as to entrepreneurs who are looking to set up shop in Michigan.

(Common Citizen via Facebook)

And more importantly, he said it would also serve as a greenlight for banks to do business with cannabis workers and ensure they aren’t discriminated against because they work with weed.

“It takes a lot of hard working folks to support this industry, and they do one heck of a job,” Beck said. “So, why wouldn’t we want to support them with the same type of financial capabilities? These folks work just as hard as anybody else who works hard for their pay. It’s about fairness.”

A US Senate committee approved the SAFER Banking Act in September and Senate Majority Leader Chuck Schumer has since vowed to move the bill to the Senate floor for a full vote “soon”—though it doesn’t appear anywhere near the finish line as 2023 draws to a close.

READ MORE: Your 2023 Michigan cannabis gift guide

Want more cannabis news delivered right to your inbox? Click here to sign up for The MichiGanja Report—our free, twice-a-month newsletter about all things marijuana.

Politics

Trump says he would allow red states to track pregnancies, prosecute abortion ban violators

In an interview published by Time magazine this week, former president Donald Trump detailed his plans for a potential second term and said he would...

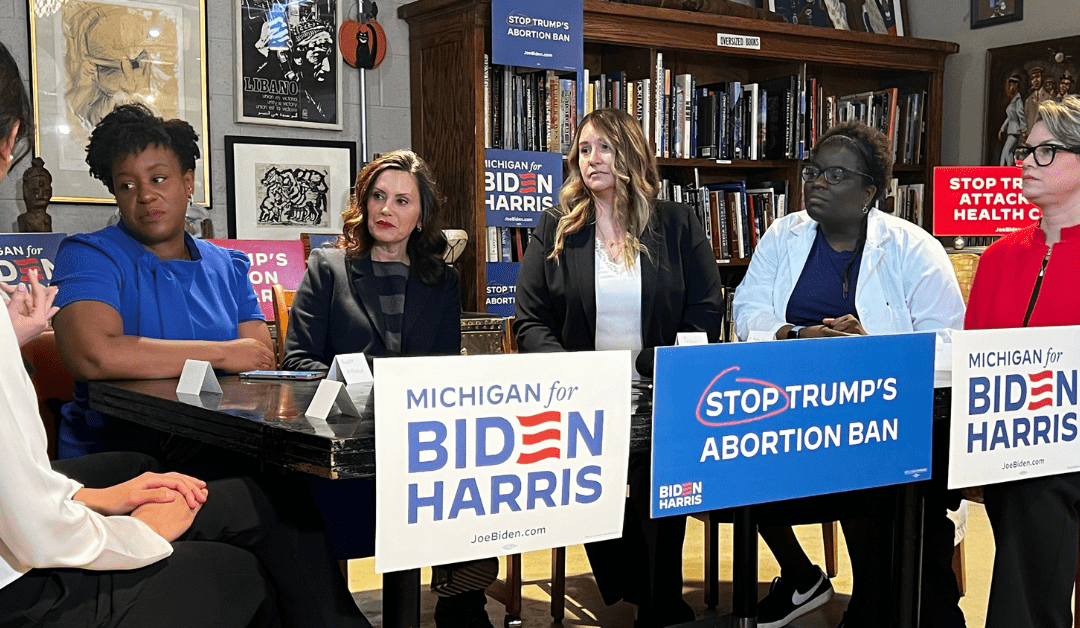

Whitmer: Reproductive rights still ‘in jeopardy’ in Michigan

Michigan Gov. Gretchen Whitmer is urging Michiganders to re-elect President Joe Biden in November—or else risk losing access to reproductive...

How to apply for a job in the American Climate Corps

The Biden administration announced its plans to expand its New Deal-style American Climate Corps (ACC) green jobs training program last week. ...

Local News

Detroit date night done right: 12 fresh and exciting ideas

Whether you want to make a good first impression with your latest Bumble match or surprise your spouse with an exciting evening out, Detroit is full...

Black cowboy culture will be on full display at upcoming Flint rodeo

Flint, Michigan, is set to host an exciting and culturally significant event this June: the Midwest Invitational Rodeo. This eagerly anticipated...